Top 10 countries in the global shell & tube heat exchangers market (USD million in 2024).

The evolution of heat exchangers has been remarkable. Patented in the late 1800s, early designs led to modern shell and tube heat exchangers (STHEs) decades later. Known for efficiency and versatility, STHEs transfer heat between fluids and are widely used in key industries. In 2024, they held ~25% of the USD 16 billion global heat exchanger market, highlighting their importance in thermal management.

Text & images by Stratview Research

Top applications of shell and tube heat exchangers

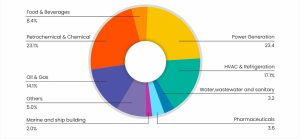

The initial designs of the STHEs were developed to fill the needs in power plants for large heat exchanger surfaces such as condensers and for the oil industry in oil heaters/coolers, reboilers, condensers, etc. in crude oil plants. Even today, STHEs are the preferred choice in the power generation sector where they are used for different applications including feed water pre-heating, cooling gearbox oil, seal water, and generator cores, as well as recovering heat from exhaust gases to enhance overall efficiency. In 2024, the demand from the power generation sector for STHEs was valued at >USD 900 million, representing over 23% of the global STHE market value, making it the largest segment (see Figure 1).

The petrochemical and chemical industry, although the second-largest end-user of STHEs, was very close to the power generation industry in market share. Both industries together accounted for >45% of the global STHEs market. The heat exchangers are primarily used in heating or cooling of reactors, recovering heat from waste streams, and regulating the temperature of various chemicals and solvents by heating or cooling them during processing.

Following closely is the HVAC and refrigeration sector, which represented approximately 17% of the total market share in 2024. The increasing demand for heating, ventilation, and air conditioning (HVAC) systems worldwide, driven by urbanization and climate change concerns, ensures a continuous need for effective heat exchangers. Heat exchangers like STHEs allow smooth heat transfer between air and refrigerant for efficient cooling and heating in buildings.

The food and beverage industry comprises different operations, majorly being the pasteurization of dairy products, processing of fruits, vegetables, prepared foods, brewing, and other dietary supplements, etc., that creates a consistent demand for heating and cooling solutions. These solutions eliminate microbials to ensure product safety, preventing spoilage and making the product safe for consumption. In 2024, the demand for STHEs in this industry accounted for a smaller market share of approximately 8%. Other sectors like water treatment, pharmaceuticals, and marine applications demand STHEs as well but collectively contribute less than 10% to the global shell and tube heat exchangers market.

The dominance of Asia-Pacific

In 2024, the United States, China & Germany were the top 3 countries generating nearly half of the demand for STHEs. While the United States & China were close having a demand value of USD 790 million (~21% share) and USD 680 million respectively (18% share) in 2024, Germany was far behind them with a value of USD 280 million.

Among the regions, the demand from Asia-Pacific reached approximately USD 1,430 million in 2024, which is more than 35% of the global STHE market.

APAC’s dominance can be linked to certain factors including a significant demand coming from the power generation sector, which accounted for over 28% (in 2024) of the total the STHEs demand from the region. Home to >60% of the world’s population, the APAC region is playing a critical role in shaping the global energy future. Growing economies, increasing energy demand from this region, and a push towards renewable energy sources, etc., are demanding reliable heat transfer technologies. Studies have predicted that by 2030, renewables are set to make up 30% to 50% of the power-generation mix in most Asia-Pacific markets. This transition is likely to increase the demand for STHEs, as they are essential in optimizing the efficiency of renewable energy systems, such as solar thermal and biomass plants.

The petrochemical and chemical industries closely follow the power generation sector in demand for STHEs in the APAC region with a share of ~26%, totalling > USD 370 million in sales value in 2024.

The APAC region also leads the global petrochemical market, with China as the foremost producer of industrial chemicals. In 2023, the Asia Pacific petrochemical market was valued at ~USD 325 billion, driven by rapid industrialization and strong demand from industries like automotive and packaging. China’s self-sufficiency policy has significantly strengthened its position in the global petrochemical market.

Japan & India are the next two large demand generators in Asia-Pacific region together accounting for nearly 30% of the region’s market.

Increasing focus on less carbon-intensive activities and demand for sustainable energy usage is driving demand for thermal management solutions like STHEs in the European region too. With countries like Germany and France making substantial contributions to the global STHEs market, Europe stands as the next largest market after Asia-Pacific.

The challenges

The STHE market is currently at crossroads witnessing growth alongside some significant challenges, and promising opportunities.

The production of STHEs is significantly impacted by high raw material costs, which directly affect the initial installation expenses for heat exchanger setups. All types of heat exchangers are prone to corrosion, fouling, etc. due to heavy interaction with liquids, extreme temperatures and different chemicals, etc. To safeguard the equipment from certain challenges, it is vital to the choose proper materials for manufacturing. The best material for non-corrosive heat exchangers depends on the environment they’ll be used in, but common choices include stainless steel, nickel alloys, etc.

Prices of stainless steel, and nickel – crucial for nickel alloys used in heat exchangers, are projected to be influenced by global supply, shifting economic conditions, and demand dynamics. It is clear that there is a struggle to meet demand due to limited raw material availability or logistic challenges. It also depicts fluctuating prices of crucial raw materials that may experience price pressures due to market conditions, further impacting the STHEs market too. High overall expense makes it challenging for new entrants to compete against established manufacturers and can deter smaller players from entering the market.

Moreover, the STHEs’ market depends heavily on maintenance to ensure operational efficiency and reduce overall costs. The growing aftermarket for STHEs creates a lucrative opportunity for spare parts and maintenance service providers and suppliers. Several original equipment manufacturers (OEMs) like Alfa Laval AB, Funke Warmeaustauscher Apparatebau GmbH, Kelvion Holdings GmbH, etc. are into manufacturing original equipment and also offer spare parts and maintenance services to ensure optimal performance of their equipment.

Emerging trends and prospects

Tracing back from ancient systems like the hypocaust to today’s connected, micro and nano heat exchangers, the progression reflects significant advancements driven by technological innovations and trends.

One such trend is the integration of renewable energy systems with heat exchangers, enabling efficient utilization of waste heat and the integration of thermal energy storage. Solar water heaters are the perfect example. Shell and tube heat exchangers move solar power from collectors to water for drinking.

The development of smart heat exchangers equipped with Internet of Things (IoT) technology, sensors and control systems has emerged as a game-changer. By integrating Internet of Things (IoT) technology, these devices provide real-time monitoring, predictive maintenance, and optimized performance. Additionally, studies have shown that companies have saved energy by up to 25% after integrating smart heat exchangers into their systems.

Emerging nanomaterials like Graphene and carbon nanotubes, and polymer composites have shown exceptional thermal conductivity, significantly higher than conventional materials. Replacing copper and aluminum with highly conductive polymer composites in heat exchangers can reduce materials costs and overall manufacturing costs, providing energy savings during manufacturing and end use. The U.S Dept of Energy considers, the manufacturing time for polymer composite heat exchangers can be reduced by up to 90% compared to metallic ones. Additionally, overall material and manufacturing costs could drop by as much as 50%. As industries increasingly focus on reducing CO2 emissions, the demand for efficient heat transfer solutions is set to surge, particularly due to the growth of renewable energy sectors like solar thermal power, geothermal, and wind energy. The International Energy Agency (IEA) projects that the world will add 5,500 gigawatts (GW) of new renewable capacity between 2024 and 2030.

These sectors require effective heat exchangers to optimize their systems. The global market for STHEs is projected to grow steadily from approximately USD 3.8 billion in 2024 to an estimated USD 4.9 billion by 2030. As innovations in heat exchanger technology continue, STHEs will play a critical role in addressing global energy challenges and reducing carbon emissions, ultimately contributing to a greener industrial landscape.

About this Featured Story

Why Subscribe?

Featured Stories are regularly shared with our Heat Exchanger World community. Join us and share your own Featured Story on Heat Exchanger World online and in print.